Banks, private and state, are trying to bring clients with their credit proposals. For this reason, in advertisements, you can often see attractive loans rates, and in fact the overpayment is a large amount. The total cost of the loan is a formula, the decoding of which includes in addition to the interest rate, all additional payments on consumer or any other loan.

What is the full cost of the loan

Taking advantage of the bank's offer to take money from him, you should always know that interest is just the payment for the use of money. In addition, there are additional commissions that also plunge on monthly payments. The whole amount of these components is called a complete interest rate. PSK, such an abbreviation of this indicator is the main importance to which it is necessary to focus when a loan is selected. The provision of information on the value of the full cost loan is carried out in annual percentages and is indicated in the upper right corner of the bank loan agreement.

The concept of an effective interest rate was previously applied. It was calculated by the formula of complex interest, which included the incomplete income of the borrower from the possible investment of interest payments for loan throughout the credit period under the same interest rate as the loan. For this reason, even in the absence of additional payments, the rate value was higher than the nominal. It did not reflect the real cost of the debt service borrower, as the Bank's client recognized only when it comes to pay for a loan.

Legal regulation

Seeing such a state of affairs, the central bank has become over the side of ordinary people and ordered all credit and financial institutions to convey to customers the full cost of the loan. In 2008, the Bank of Russia issued an indication of "On the procedure for calculating and bringing to a borrower - an individual of the full cost of the loan." After the entry into force of the Federal Law "On Consumer Loan (Loan)", but it happened on July 1, 2014, the value of the total value of borrowed funds is determined depending on the subsidia-established central bank.

How to find out the price of a loan

It is noteworthy, but in microfinance companies, the full cost of the loan is always indicated, and all other payments concern only penalties and fines for the delay and non-fulfillment of obligations. In the bank, the main indicator is the interest rate for the use of a loan, additional payments that relate to the loan are indicated by individual items in the contract and additional agreements to it.

Notification of the full cost of the loan

Previously, the indicator of the PSK could be indicated in the contract, but the value there was spelled out by small font, which was not immediately in the eye. According to the Federal Law, the loan agreement is divided into 2 parts: general and individual conditions. So, in the second part, which has a tabular shape, the number of PCs is necessarily prescribed by the largest font that is applied when designing. An indication of the information is made in the frame, which should cover at least 5% of the area of \u200b\u200bthe entire sheet, on which individual credit conditions are prescribed.

What includes the full cost of the loan

The maximum possible value of the PSK should not exceed one third of the average indicator of the average value and is communicated to the borrower at mandatory. In order to figure out where the total number of PSK flows from and why it sometimes may differ from the value in advertising or on the credit organization's website, it is necessary to know all its components. These include:

- loan body and interest on it;

- fee for consideration of the application;

- commissions for issuing loan agreements and their issuance;

- interest for opening and annual account maintenance (loan) or credit card;

- the liability insurance of the borrower;

- assessment and insurance of pledge;

- voluntary insurance;

- notarial design.

What expenses do not increase the cost of the loan

In addition to the obligatory payments, which are included in the PCT, other payments may be charged from a lender, which do not affect the calculation of effective, i.e. Full bets:

- fee for failure to fulfill the contract. These include all sorts of fine and penalties, accrued due to the late payment of the next payment.

- voluntary payments. These include the Bank's Commission for early repayment of the loan, payment for extracting and references, restoring a lost credit card, etc.

- additional contributions. Here we are talking about payments that do not relate to the contract, but may be mandatory in connection with Russian legislation (for example, the CCEDo Police) or initiated by the loan to the loan (additional insurance).

How to calculate the full cost of the loan

You can ask in the formula of the PSK before the conclusion of the contract in the Bank's Office. It must be submitted to the agreement before signing the agreement. You can calculate it and independently. However, in this case, it is necessary to carefully approach the calculation and not to miss a single moment, as this may lead to inaccuracies. Very often, the borrowers allow gross errors, inattentively reading the contract and skipping certain data.

Formula PSK.

The calculation of the full cost of the loan is made on the basis of the norms established by the Central Bank of Russia. The formula itself and the calculation algorithm are constantly being improved, therefore, independently determining the PCT, you need to seek the latest relevant data, which are published on the regulator's website. The latest changes in the methodology were made in connection with the adoption of the Consumer Lending Act. The size of the PSK is calculated as follows:

Psk \u003d i × pbp × 100, where

Psk - the full cost of the loan, expressed as a percentage with an accuracy of the third mark after the comma;

ChbP - the number of basic periods throughout the calendar year (according to the Central Bank methodology one year is 365 days);

i is the percentage rate of the base period, which is expressed in decimal form.

(FORMULA)

Σ is Sigma, which means summation (in this formula - from the first payment to M-th).

DPK - the sum of the K th money payment under the contract. The amount of the loan provided to the borrower is made to the sign "-", and payments to return with the sign "+".

qK - the number of full base periods from the moment of issuing a loan to the date of the k-th payment.

eK - a deadline that is expressed in the shares of the base period, from the end of the QK-th base period to the date of the K-th payment. If the debt payment is carried out strictly according to the repayment schedule, the value will be zero. In this case, the formula has a simplified view.

m is the number of payments.

i - the percentage rate of the base period, expressed not in percent, and decimal form.

Algorithm of calculation

As can be seen from the calculation formula above, the loan rates are calculated simply, with the exception of the indicator referred to as the interest rate of the base period. This is the most complex indicator for calculating, not everyone can cope with. Calculate the same multi-year loans are physically unrealistic. To simplify calculations, you can contact online calculators or directly to the bank. In addition, if you think that the rate given in the contract is not accurate, you can send a copy of the contract to the Central Bank with a request to calculate the correct value.

Complete Cost Consumer Credit

Before concluding a consumer loan agreement, the Bank's employee is obliged to inform the loan to the real value of the loan, which is often confused with the interest rate. Banks can impose payment of services, such as Internet banking or SMS notification, the fee for which is charged only with the permission of the borrower. The full cost includes not only the overpayment amount formed in connection with the accrued interest, but also the payment of the following operations:

- consideration of the application;

- issuing a loan;

- bank card issue;

- issuance of cash from the cashier;

- life insurance (optional).

Loan price when buying a car

By buying a car on credit, you should know that four sides are involved in the transaction. First, it is a buyer and a bank who credits the purchase, and secondly, the seller, which can be a car dealership or private person, and an insurance company. It is worth saying that the insurance of the car on the CASCO system is required if the vehicle is transmitted to the bank as a collateral. Otherwise, the requirement to acquire the insurance policy is illegal.

The total cost of the credit on the car is calculated taking into account payments in the following positions:

- interest charges;

- commissions for transferring funds to the seller's account;

- pledge insurance;

- additional expenses of the borrower associated with the notarization of documents.

The cost of mortgage lending

It became easier to become the owner of own meters with the advent of the mortgage. Banks offer various lending options - with an initial contribution or without, with state subsidy or the use of maternal capital - all this will affect the full cost of the loan. In addition to paying interest to the PCD to buy real estate, add the following list of payments:

- insurance of mortgage property (payments of the loose-based deposit insurance loan is included in the calculation of the PSK in the amount of the proportional part of the real estate price paid by the loan, as well as the ratio of the period of lending and the term of insurance, if the borrowing period is less than the insurance period);

- property valuation;

- notarial design of the transaction;

- payment for making a mortgage loan and transfer of funds to the account.

All payments to third parties (notarial, insurance and other companies) are manufactured using the tariffs of these organizations. If the contract provides for the minimum monthly payment, the calculation of the full cost of the consumer loan occurs based on this condition.

An example of calculating PSK.

- the main amount of the loan is 340,000 rubles;

- credit period - 24 months;

- the rate is 13% per annum;

- commission for the provision of a loan - 2.8% of the total;

- commission for issuing cash from the bank's office - 2.5%.

Below is a system with monthly uniform payments. The amount of interest accrued for the period will be 72414 rubles (it can be viewed in the contract or payment schedule).

Then calculate the amount of the Commission for issuing a loan and cashing:

340000 × 2.8% \u003d 9520 rubles;

340000 × 2.5% \u003d 8500 rubles.

After that, we summarize all the indicators and get:

340000 + 72414 + 9520 + 8500 \u003d 430434 ruble.

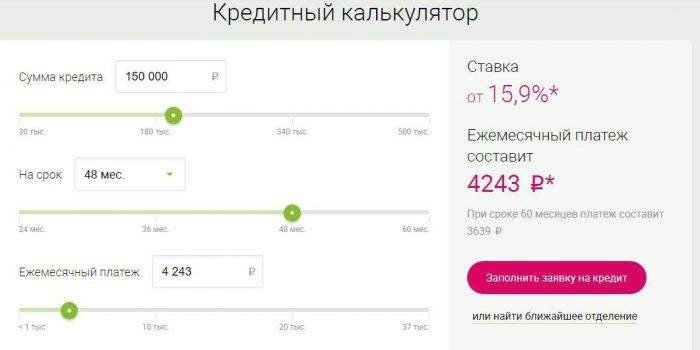

Online calculator

The network has a large number of credit calculators that will help calculate the PSK of standard loans, microloans and even overdrafts. However, it is necessary to understand that due to the fact that each bank has its own version of the bid, the data may differ. In addition, it is necessary to take into account the date of issuing a loan and repayment, and more ways to object to the amount of debt: annuity, differentiated or boblit.

Maximum and weighted average value of consumer loans

The Central Bank quarterly expects and publishes the average value of the PSK in various types of consumer loans. The main thing is that the maximum loan rate does not exceed the weighted average rate of more than a third. Below are values \u200b\u200bfor the 3rd quarter of 2019, taken from official sources:

| The average values \u200b\u200bof the total value of consumer loans,% | Limit values \u200b\u200bof the full cost of consumer loans,% |

|

| Consumer loans for the acquisition of vehicles with simultaneous transmission to pledge |

||

| motor vehicles, the mileage of which is 0-1000 km | ||

| motor vehicles, the mileage of which is more than 1000 km | ||

| Consumer loans with a limit of borrowing (over the amount of limit borrowing on the day of signing the contract) |

||

| 30000-100000 p. | ||

| 100000-300000 p. | ||

| Over 300000 p. | ||

| Targeted consumer loans, which are issued through the transfer of credit funds by a trade and service company to the payment of goods (services), if there is a relevant agreement (POS credits) without ensuring |

||

| 30000-100000 p. | ||

| Over 100000 p. | ||

| More than a year: |

||

| 30000-100000 p. | ||

| Over 100000 p. | ||

| Neamed consumer loans, targeted consumer loans without collateral, consumer loans for refinancing of debt (except POS credits) |

||

| 30000-100000 p. | ||

| 100000-300000 p. | ||

| Over 300000 p. | ||

| More than a year: |

||

|

How to reduce loan costHaving received information about the full cost of the loan, sometimes there is a desire to take money into debt. However, if you approach this issue with the mind, you can reduce the digit offered by the bank. For this, there are different number of ways:

Video | ||