The mass spread of non-cash calculation explains the fact that in certain situations the lack of funds on the card account becomes a big problem. How to put money on a Sberbank card without a card? Consider the most convenient ways.

Cash replenishment

All self-service banking devices take to credit into a bank account of cash only when placing a card in the device card receiver. This is how the customer is identified. Therefore, put money on a Sberbank card through an ATM without a card will not work directly.

Put cash on the Sberbank Card without a map, contacting employees:

- Sberbank;

- another financial institution (another bank);

- "Mail of Russia".

To perform the operation you need to present:

- passport;

- cash;

- payment details cards.

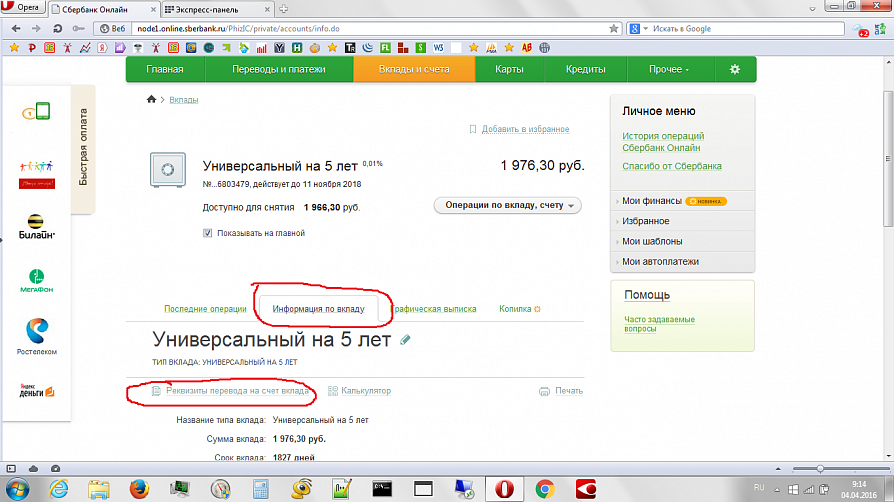

If the translation is performed in Sberbank, then the number of the card or account attached to it. When accessing third-party systems, you need to provide payment details. They can be printed in the Personal Account in Sberbank online, get in an ATM or from the bank's operator.

Financial organizations in the provision of services in favor of customers of other structures practices the fee of the commission, which can reach 10% of the amount of the operation.

The term of enrollment by other banks will be 3-5 working days. "Russian Post" for translation will be required 7-10 business days.

CIWI terminals

Put cash on the card account you can and through the payment terminal QIWI. Thus, you can translate funds in the amount of no more than 15,000 rubles per transaction.

How to put money on a card without a Sberbank card in QIWI terminals:

- you should enter the section of the Main Menu "Payment Services";

- a list of possible ways to translate funds will open. Among them, you need to choose a payment system card;

- the recipient's card number is entered;

- specifies the contact phone number;

- checking the payment parameters;

- cash will make cash in the bill acceptor. The device does not give out of delivery, because the translation should be prepared for the required amount in advance;

- payment is made. If necessary, at this stage can be reported bills;

- the transaction is confirmed.

When performing this operation, it should be borne in mind that the system will take the commission at the expense of the amount made.

Check, issued by the terminal, should be kept until confirming the receipt of funds for a card account. If you have any problems with payment, you must contact the person installed the device. Contact intermediary data are indicated on the check.

Significant shortcomings of terminals is that they take a big commission, and funds will be credited to the account within 5 days.

Sometimes, due to the technical failure, such devices do not issue checks, with the result that the error in the account number or problem of the system itself will lead to the loss of funds.

Replenishment by cashless translation

Is it possible to put money on a Sberbank card without a card? Yes, if there is an electronic wallet Yandex.Money, Webmoney or QIWI, to which a card account is attached. Recently, these services in order to improve safety at the registration stage are asked users to indicate payment details of bank cards. Without specifying this parameter, the payment systems denied the implementation of money transfers.

Translation from the electronic wallet is accompanied by the Commission's charge. On the operation itself leaves from a few minutes to 5 business days.

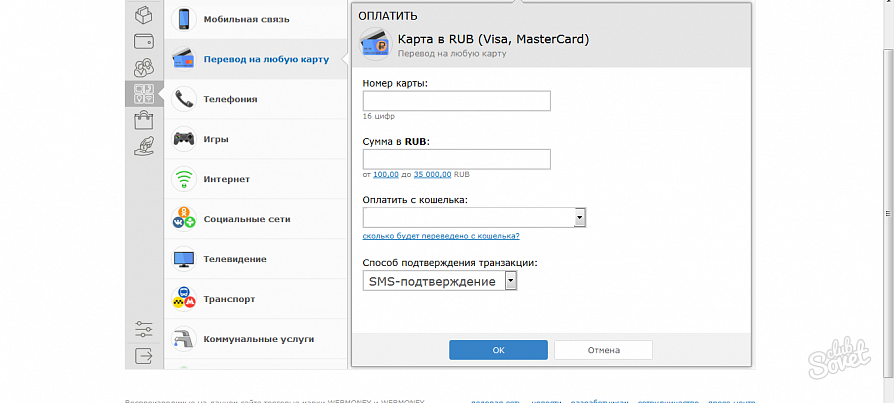

For example, to replenish the Sberbank Card in WebMoney.

- go to your personal account using the login and password;

- in the left column there is a payment "Payment" icon;

- in the menu that appears, the Translation to any Map tab is required;

- next, you should choose the currency of the deposit;

- then the card number is entered, as well as the amount that will be credited to the account;

- refine payment data. At the same time, it is necessary to take into account the magnitude of the Commission. It is 4.8% of the amount of the operation plus 15 rubles;

- the operation is confirmed;

- an SMS message with a disposable password will come to the phone number. For this informing from the account spikes 1.5 rubles. Personal code should be entered into the application card and reaffirm the operation.

In the QIWI payment system, the Sberbank card operation is performed according to a similar scheme: a serial transition is made by "Translate" links - "on a bank card" and the corresponding rows are filled. The Commission in this system is 2% plus 50 rubles.

In Yandex.Money, the replenishment of the Sberbank card is implemented by switching over links:

- "Money";

- "Remove";

- "Translate to a bank card";

- "On the card of any bank."

Then you should fill out the necessary fields and then follow the instructions of the payment system. The Yandex.Money Commission will be 3% plus 45 rubles.

The replenishment of the card account opened in Sberbank is possible through Internet banking services as a given organization and other banks.

Replenishing the Sberbank Card from the phone number

Replenishment of the Sberbank card is possible from MTS phone numbers, MegaFon and Beeline. The Commission in this case reaches 4-8% plus a fixed part of it in the amount of from 10 to 259 rubles.

Transactions are carried out on the official website of the corresponding telephone operator.

MTS

MTS subscribers can transfer to Sberbank Card from 1,700 rubles to 15,000 rubles at the commission of 4% (minimum of 25 rubles). The maximum permissible number of operations per day - 5.

- "Financial services and payments";

- "Money transfers";

- "On a bank card."

Megaphone

MegaFon allows its subscribers to translate up to 15,000 rubles. Commission - 7.35% and 95 rubles. With the amount of operation more than 5,000 rubles, an additional fee will be 259 rubles.

To replenish the Sberbank card, you must consistently go through links:

- Private clients (left upper screen corner);

- Services;

- Additional services;

- Money transfers;

- From the phone to the bank card.

Then, following the instructions of the system, filled empty fields.

The second way to make a translation to the card is the direction of the message of the type "Card XXXXXXXXXXXXXXXX MM YY SSSS" to the number 3116, where:

- Xxxxxxxxxxxxxxxx - 16-thymawal card number;

- MM YY - term (month and year) of its action;

- SSSS - the amount of the operation.

Beeline

Bilayne subscribers can send to a card, open in Sberbank, from 50 to 14,000 rubles. Commission - 5.95% plus 10 rubles.

On the Bilayna website you need to follow the links:

- "Payment and Finance";

- "Payment for services";

- "All services";

- "Money transfers".

This section should select the required payment system and then follow the instructions of the service.

From the Bilain number you can send to the number 7878 and the SMS command "Card XXXXXXXXXXXXXXX SSSS", where:

- instead of Card write the name of the card payment system (Visa, MasterCard, Maestro);

- Xxxxxxxxxxxxxxxx - its number;

- SSSS - the amount of the operation.

"Mobile Bank"

You can also use the Mobile Bank service. If it is connected if there is enough funds on the card account, then the "Translation of the 9xxxxxxxxxxxxxxx" 0000 "command is sent to the phone number 900, where:

- Translation - command to perform operation;

- 9xxxxxxxxx - the phone number of the recipient of funds in a 10-digit format;

- 0000 - the amount of translation.

In response, a message will come with an individual code. This cipher should be sent to the number 900. This will be confirmed by the replenishment of the card account of another subscriber.

To translate between your accounts instead of the phone number, you should specify the last digits of the XXXX UUU cards, where XXXX is a CIFR card with which funds are transferred, and the UUU is on which they will be enrolled.