Definitions of the described item

Banking personal account

Facial account Taxpayer

Face Account Rules

Facial accounts.

Procedure for opening facial accounts

The procedure for maintaining personal accounts

Accounting for taxes in facial personal accounts. persons

- Accounting and the transfer of personal accounts in the reorganization of JUR. Persons

- Accounting and the transfer of personal accounts when changing the location

taxpayer (Tax Agent)

Summing up in facial accounts

Checking facial accounts

Closing the facial accounts at the end of the budget year

Types of personal accounts

Individual facial account Insured face

Facial account employee

Regulations

Term of storage of personal accounts

Responsibility for the absence of facial accounts

Separation of the personal account

Facial account depot

Definitions of the described item

Facial account- this is Account discovering by accounting or bank accounting for payments with individuals.

Facial account- this isa set of records intended for accounting securities of one monetary emission on one analytical account and possessing the same set of permissible depositary operations.

Facial account- this is Accounting account designed to account for settlements with debtors and borrowers: physical and yur. persons, including financial, credit institutions, and TZH. State bodies.

Facial account - this is account for keeping accounting calculations with physical and legal entitieswhich reflects all financial and credit operations with a specific client.

Banking personal account

Banking personal account - a bank document reflecting all financial relationships bank With his client. Multiple personal accounts can be opened to the same client.

Facial accounts open legal entities. Persons for accounting for cash and settlements on operating, investment and financial activities (settlement and current accounts).

Facial accounts also open banks phys. Persons (depositor); They take into account the movement of deposits at the acquisition and expenditure orders, as well as interest accrued interest on the contribution.

Before opening the facial account in the bank, first of all, it is necessary to decide whether you need a savings or current account. Savings account can be opened as on phys. faceAnd on legal, but the calculated operations on a savings account are not welcome, because, as follows from the very name of the account, it is assumed for savings.

Bankers themselves, today, began to recommend opening savings accounts to JUR. Persons, since in the global banking community is always visible, the name and surname go, which makes the storage of funds are absolutely not confidential.

Next, do not forget that the requirements for the provision of information when opening a personal account of the client in all banks are different. Those. It is worth assessing the degree of your readiness to disclose information. It is important to determine whether you need Russian-speaking staff, how critical the restrictions on the average monthly number of operations, in which language should be Internet banking, do you need an account that allows you to work with zero balance or you can afford to keep balances and in what size, the rate of implementation payments, and so on.

Estimated business type. Some banks open accounts only under specific types of business, such as trade, and categorically do not accept companies with an investment activity. Some banks are "omnivores" and will take any kind of activity. Some have special rules on certain types of business. We pay your attention that all banks, without exception, will ask you a detailed indication of the specifics of the activity (that is, they will not be content with an indication of simply "trade, services or mediation activities", at least it will have to specify trade and services - trade than, what kind of product, services in which area, etc.)

Transaction partner countries. When choosing a bank to open an account, it is important to take into account countries of contract partners. So, for example: Turkish firms Can't pay for Cyprus banks, even though Cypriot banks are ready to take funds listed from Turkey. Or European companies are always easier to implement payments In the European banks. When choosing a bank for a savings account, it is necessary to guide the Bank's reliability, as well as the legislation of the Bank's country regarding storage and provision information About customers to third parties. In some cases, it also turns out to be offshore, ready to work with the "soft" currencies of the CIS countries.

Date of registration as an insured person;

Periods of labor and (or) other activities included in the insurance experience for the appointment of a labor pension, as well as insurance experience associated with the special working conditions, work in the districts of the Far North and equal to them areas;

Other periods counted in the insurance experience in accordance with Article 11 of the Federal Law of December 17, 2001 N 173-FZ "On Labor pensions in the Russian Federation";

The amounts of payments made at the expense of pension savings.

In the professional part of the individual personal account of the insured person indicate:

The amounts of insurance premiums that were additionally paid and received for the insured person who is subject to a professional pension system;

Amounts of investment income;

Professional experience;

Amounts made payments.

The personal account is kept by the Pension Fund of Russia throughout the life of the insured person.

After the death of the insured person, the personal account closes and stored during the period provided for the storage of pension affairs.

Facial account employee

- Originated decoration

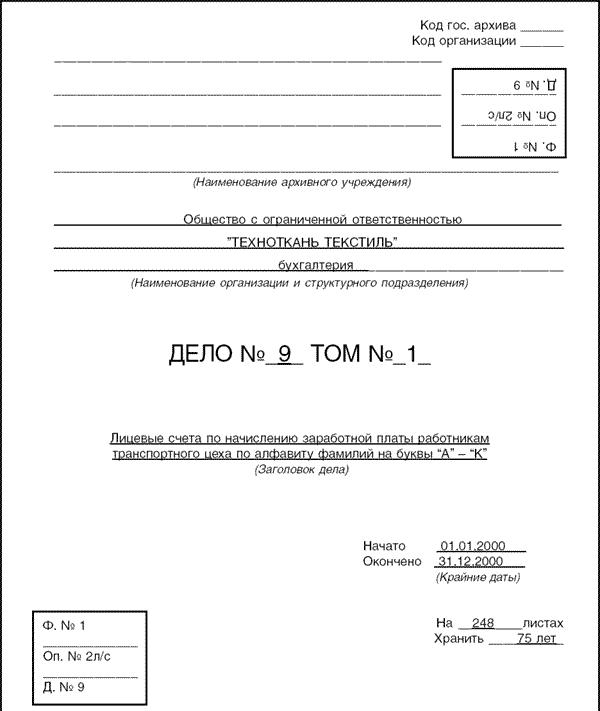

Facial account (form No. T-54) is used to reflect all types of accruals wages worker.

It is filled on on the basis of primary documents on the accounting and completed work (dresses, orders, outfits, booking books, etc.), spent time (accounting tables for the use of working time form N T-12 and N T-13).

Information is reflected from orders (orders) on the promotion of workers of the form N T-11 and N T-11A, notes for the provision of vacation to the employee (form N T-60) and under the termination of the employment agreement (contract) with the employee (form N T -61), an act of acceptance of work carried out under an employment contract (contract) concluded during the implementation of a certain work (form N T-73), leaves and certificates for extra charge, hospital sheets, etc. documents.

At the same time, the calculation of all holds from wages Taking into account the tax deductions led by this employee, benefits and determines the amount to pay in hand.

Large enterprises open the personal account for each employee, small enterprises Prefer to use the settlement payroll (forms T-49), combining the functions of the calculated (T-51 form), the payment (form No. T-53) of the statement and the personal account of the employee (forms T-54 and T-54a).

The personal account is filled with accounting worker.

The changes made to the T-54 form are associated with changes in the calculation of the tax on the income of individuals, the introduction of the INN and insurance certificates of state pension insurance, reduction of payments, allowances on most enterprises.

The general-industry forms of personal accounts are contained in the Resolution of the State Statistics Committee of the USSR of December 28, 1989 No. 241 "On Approval of Forms of Primary Accounting Documentation for Enterprises and Organizations" (with changes and additions made by the State Statistics Committee of the USSR from 28.06.1990 No. 94) (hereinafter - Resolution No. 241 ). By Resolution No. 241, two forms of the personal account were approved - T-54 and T-54A. These documents, along with the settlement and payment statement (form T-49), the estimated statement (T-51 form) and the payment statement (T-53 form) refer to the group of documents on the accounting of settlements with workers and employees.

The personal account or the corresponding document opens by accounting on the basis of an order for employment.

Resolution No. 241 is enshrined that the personal account is applied to reflect wages for past periods and pensions. In practice, personal accounts are applied to the monthly reflection of wage information paid by the employee during the calendar year. The personal account of the employee of accounting is filled.

The facial account of the T-54 form is used to record all types of accruals and retaining from wages. With a disavay calculation of wages, records of accruals and holds in the form of T-54 are made by two lines. If necessary, you can make a final string in each column.

Based on the personal account data, the payment statement of the T-49 form is drawn up.

The T-54a form is used in the processing of credentials using computing equipment using special programs and contains conditionally permanent details about the employee necessary to accrual the wages. Data on salary calculation is invested monthly in the personal account of the employee on paper. The content of the graph of the personal account of the personal account can be printed on a third form page or on the machine itself. The second and fourth pages are used to print the types of payments and deductions.

Free graphs in the top table of the T-54a form can be used for different necessary records.

The procedure for conducting documentation for labor accounting, wages and payments with employees is paid to much attention. Facial accounts are needed incl. To verify the accuracy of individual information provided by the insureders about the payments accrued in favor of insured persons (to verify the correctness of the calculation of contributions on the mandatory types of social and state insurance against industrial accidents and occupational diseases). In the absence of personal accounts in the organization, the reconciliation of individual information is carried out with the estimated, settlement payments, books on calculations with workers and employees, etc.

The personal account is a document confirming the employment of the employee. In this regard, on the basis of personal accounts, it is possible to introduce corrections to the information contained in the employment record (about work, about awarding and promotion for success in labor), in case of loss of the original of the order (orders) of the employer or the inconsistency of the wording in it actually performed (See paragraph 39 instructions on the procedure for conducting labor books of workers approved by the Decree of the Ministry of Labor of the Republic of Belarus dated 09.03.1998 No. 30, as amended by the decree of 11.05.2000 No. 72, taking into account changes and additions made by the Decree of the Ministry of Labor and the Social Protection of the Republic of Belarus dated June 29, 2006 № 76).

The personal account of the T-54 form is filled with accounting worker on the basis of primary documents on how to generate, performed work, worked time and documents for different types of payments. These documents, in particular, include:

Accounting tab of working time and payroll (Form T-12);

Working time accounting tab (T-13 form);

Route sheets;

Waybills;

Reports about work out;

Outfits for piecework and others.

The listed documents are transmitted to the accounting department to accrual wages on time, approved by the organization's document management schedule. The personal account is signed by an accounting worker leading the calculation of the salary of this employee.

Based on the personal accounts of employees, the settlement and payment statement (form No. P-49) is filled out, the estimated statement (form No. 51), the payment statement (form No. DM-53).

The form N T-54A is used in the processing of credentials using computing equipment (SVT) and contains only conditionally permanent details about the employee. Data on the calculation of wages obtained on paper carriers are invested in a monthly account. The second page is used to print the types of payments and deductions.

- Storage of facial accounts

Clause 3 of the Resolution of the Council of Ministers of the Republic of Belarus dated 10.12.1997 No. 1635 "On Labor Books of Workers" is given the indication of employers to take measures to severely comply with the established procedure for storing archival documents (orders for acceptance and dismissal, facial accounts and wage issues and other documents, containing information about working periods).

Article 473 of the list of standard documents of government and management bodies, institutions, organizations and enterprises of the Republic of Belarus on the organization of the management system, pricing, finance, insurance, management of state property, privatization, foreign economic relations with the indication of storage time approved by the Resolution of the State Committee for RB of 06.08.2001 No. 38, it is enshrined that facial accounts (calculated sheets) on wages are stored by all organizations (both are not the sources of the recruitment of state archives) of 75 years. Article 464 of the named list also found that the settlement payroll wages are stored for 3 years, and in the absence of personal accounts - 75 years.

- Association for the absence of facial accounts

The legislation provides for the responsibility for the nonstation of the preservation of documents on labor accounting, wages and settlements with employees.

Considering that personal accounts relate to accounting documents, for violations related to their storage, as a rule, apply the norms of Article 151-3 "Violation of the procedure for conducting accounting and reporting, the destruction of documents or their concealment" CACAP RB of 06.12.1984 No. 4048-x.

So, this article establishes that violation by the head, chief accountant or other officials of the Jurlitz or individual businessman The established procedure for conducting accounting and reporting entails the imposition of a fine in the amount of from 10 to 20 minimum wages (Note).

The destruction of these persons of accounting and other documents in violation of the established deadlines for their storage or their concealment entails the imposition of a fine in the amount of up to 100 minimum wages (Note).

Separation of the personal account

When considering various housing issues, the subject of change is often affected. agreements Hiring or as often say the partition partition.

In the Housing Code, this question is considered in some sections as for cooperative housing, and for the employers, it seemed to be out of the new Housing Code and created a bunch of difficulties in practice.

Many lawyers solve this problem by applying the norms of the Civil Code - the general rules of termination and change agreement.

Menting on the Department of Housing Policy and Housing Fund, you have the right to divide the personal account on a voluntary agreement or through court. For the account section you need to have each of three conditions:

The apartment must have an isolated residential premises (one or more rooms);

This room in size should be equal to the share of the family member, which decided to divide the personal account. As in law All residents have equal rights in spite of those who are recorded in the house book with a responsible tenant, just a living household or former family member;

The kitchen should be at least six square meters (the Supreme Court of the Russian Federation acknowledged this provision not by existing, not subject to use).

But you may refuse the Facial Account section, in the case when at least one of the rooms is recognized as unsuitable for permanent residence. Accommodation takes place in such cases if:

Entrance to a room with a width of less than 70 centimeters;

The room window goes into a closed courtyard area of \u200b\u200bless than five to five meters;

The width of the room itself is less or equal to two meters;

The distance between the windows and the wall of the opposite building does not reach three meters.

The legal meaning of the division of the personal account is to change the agreement of hiring residential premises at the request of the membership member of the employer. In other words, the change in the contract of hiring is the procedure for opening a separate personal account, after which the apartment turns into communal, and the former family members become neighbors. At the same time, the exchange of other members of your family is simplified for you. Who can demand to divide the personal account? Only one who:

Reached the age of majority and is capable;

Is a family member or a former member of the family of the employer;

Lives and registered on this housing.

Apartments in which the partition of the personal account is prohibited:

In the apartment obtained from the enterprise or institution, or organization (your place of work), provided you were fired or at your own desire without good reasons, or for violation of work discipline, or for committing a crime.

If you got an apartment in such a house, not being an employee of this enterprise, institutions, organizations or quit from there for other reasons, the ban on the partition of the personal account does not apply to you;

In office residential premises.

In the apartment owned by citizens. In this case, the forced partition of the personal account is denied.

The apartment on which arrest is imposed or there is another prohibition, for example, the production of the house for reconstruction.

If there is no obstacles to the front account section, then you need to contact control Department Housing politicians and housing fund of your district with these documents:

Application for a personal account section;

General passport;

Flaking plan of the apartment with the area of \u200b\u200bthe Rooms from BTI;

Extract from the house book;

Copy of the financial personal account;

Help about Tom has an independent earnings;

Written agreement of all other residents of the apartment for the establishment of new orders in the apartment.

Please note: in the service residential room can not be divided by the personal account. For example, if a husband who lives with his wife in a service apartment given to him in connection with the work is divorced with his wife, she does not have the right to demand the partition of the personal account.

Judicial practice on the partition section is completely ambiguous. For the Court by and large does not matter the consent of both sides to the Facial Account section. The court has the right to refuse to satisfy the claims.

The court proceeds from the fact that the plaintiff wants to change the hiring of residential premises by section of the residential premises, which the current LCD of the Russian Federation is not provided for, and the claim by the defendants, according to the court, contradicts the requirements of Art. 82 LCD RF. The change in the agreement of social hiring is real only subject to the unification of enterprises in one family of people living in the same apartment and enjoying residential premises on the basis of certain social employment agreements, and ask to conclude one social hiring agreement with any of them.

Specifically in Moscow, it will not be able to divide the personal account in the municipal apartment in the municipal apartment. According to the subject of the Federation of Moscow, the adopted rule is applied to the prohibition of the partition of the facial account and dividing apartments for utilities

In other regions of the Russian Federation, divided the personal account in the municipal apartment in practice is really and does not prohibit sue such a request.

Regarding the apartments belonging to people on the right of ownership, to re-transfer apartment to the communal in Moscow and in other regions of the Russian Federation. In this case, it is worth noting the circumstance that the division of the personal account in the apartment is directly the conclusion of a separate agreement of hiring to the room in the apartment or the design of the right of ownership and receiving a separate certificate for a specific room.

Different people think that the Communal Services Accounts section implies the separation of the personal account, which gives them the right, for example, to receive individual apartments. This opinion is delusion. Separate payment of utility services does not change the legal status of the apartment at all and does not negate any changes in the rights and obligations in relation to the citizens living in the apartment.

In judicial practice, there are no cases of separation of the personal account. So we recommend not to solve this problem yourself. It is advisable to trust an experienced lawyer (lawyer), a specialist in such matters.

Facial account depot

The personal account of the depot is a set of records intended to account for securities of one emission that are on a single analytical account of the depot and possessing the same set of permissible depositary operations.

The personal depot account is the minimum indivisible structural unit of depositary accounting. Depository operations that are applicable to securities taken into account on one person account are the same for all such securities.

For each deposit account in accordance with the Rules of Depository and Regulatory Documents of the Russian Central Bank, a synthetic depot account is defined, which reflects all securities taken into account on this personal account. The depot account section is called the accounting register of the analytical account of the depot, which is a set of personal accounts, the operations with which are regulated by one document.

Financial vocabulary

Facial account - (form No. T 54), the personal account (SVT) (Form No. T 54a) are used to reflect the wage paid to the employee; filled with employee accounting; Form No. T 54 is used to record all types of accruals and hold from ... ... Encyclopedic Dictionary-Directory Director of the Enterprise

Facial account - See the personal line of business terms. Academician. 2001 ... Business Terms Dictionary

Facial account - Account discovering by accounting or bank accounting for settlements with individuals. This account reflects all monetary credit operations with this client. Rayzberg BA, Lozovsky L.Sh., Starodubtseva E.B .. Modern Economic Dictionary. 2 ... ... Economic Dictionary is a set of data in the register registered person, form, quantity, category (type), state registration number of the issue, nominal value of securities, certificate numbers and the number of securities certified by them (in ... Depositary terms

Facial account - Facial account (accounting) Facial account (in the share register) ... Wikipedia